The video below provides a detailed overview of Capstone's award-winning, multidisciplinary captive management services.

Capstone’s planning includes:

Capstone’s planning includes:

• Feasibility study with independent, professional sign off

• Underwriting

• Claims processing

• Accounting

• CPA - independent audit

• Insurance policy design

• IRS tax controversy

• State tax issues

The benefits of managing business risks through a captive are fully realized when you’re working with a captive planning firm offering true turnkey solutions. Capstone’s reputation precedes it, with over 200 successful captives formed since 1998. The company has experience forming many captive types, including those formed under 831(b), 831(a), and 501(c)(15) of the Internal Revenue Code and has worked with mid-market businesses in a number of industries, including construction, healthcare, and manufacturing.

From the initial design straight through to ongoing management, it is the most comprehensive alternative risk planning solution available.

What is a Captive Insurance Company?

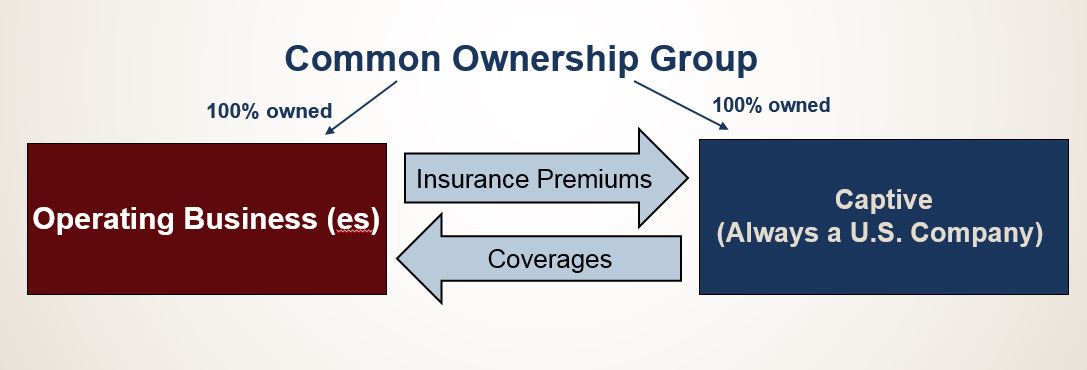

A “captive” is an insurance company that has been specifically designed to cover risks of an affiliated business. Forming a captive insurance company to cover your business’s risks is a smart way to eliminate gaps in coverage that typically come with traditional policies. More specifically, forming a captive insurance company as a supplement to traditional insurance can provide comprehensive risk coverages that are either too expensive or unavailable in the traditional market.

Under a captive arrangement, a business owner pays premiums to the captive in exchange for custom-built coverages. See the graphic below.

Many large commercial insurers have a profit motive, and as a result, may unexpectedly deny claims. Forming your own insurance company gives you control over your risk management, eliminates claim denials, and provides great ancillary financial benefits.

Captives require the expertise of professionals who understand the legal, tax, and regulatory requirements involved in the planning. Partnering with a captive management firm with in-house legal expertise ensures your insurance company is compliant with various regulatory bodies.

Avoiding Captive Industry Pitfalls

Captives are actual property & casualty companies, legally established to insure the risks of their related businesses. They are regulated by an insurance commissioner of a U.S. state or foreign jurisdiction, i.e. a captive domicile. Each domicile stipulates its own set of rules, but in general, the its purpose is to ensure that captives operate as bona fide insurance companies.

The pitfalls of working with a captive insurance manager who doesn’t have the right experience with domicile selection or captive tax laws can be disheartening for any business owner who has invested time and money into a captive planning strategy.

Many self-proclaimed captive managers have had only clerical and administrative experience. They may work at home, with a P.O. Box listed as his or her office address. Their true market focus might be to gain commission on the sale of an insurance policy or to simply grow their assets. Often, their backgrounds are difficult to gauge online.

Capstone Associated Services, Ltd. employs a qualified staff of professionals that can assist clients in the planning, from the initial feasibility study, to the design of the policies, to ongoing support. Capstone can also determine which domiciles have the best track record and are the most appropriate for your business. Determining whether to domicile onshore or offshore, recognizing improvements in regulatory standards, the number of captives domiciled within the jurisdiction all come into play.

Overall, our team is committed to excellence in captive planning, and ensures all arrangements remain compliant with established laws.

Quick Facts:

Capstone has the expertise to carry out the planning. No other captive service provider offers the same level of turnkey support throughout the life of the captive.

Capstone is a standout with:

- 25+ years in business

- CAPTIVE_FORMATIONS captives formed

- Expertise in navigating existing and new captive legislation and regulatory changes

- Recognition as a Top 20 Captive Industry Pioneer by Captive Review

- Expertise in forming captives under IRC 831(a), 831(b), and 501(c)(15) for mid-market companies

- Expertise in risk management for mid-market manufacturing, construction, healthcare and other industries

Capstone is the #1 provider of turnkey captive insurance planning and management services for the mid-market. To learn more about captive insurance and Capstone’s attorney-led captive planning, give us a call at 713.800.0550 or fill out the form. We’re looking forward to connecting with you.