By: Tim Voorhees & Sunny Boren

By: Tim Voorhees & Sunny Boren

If you work with businesses that generate annual profits of greater than $600,000, you should consider forming a captive insurance company for your business.

Captives can generate substantial insurance cost savings while minimizing business income taxes.

In addition, captives can facilitate the tax efficient transfer of wealth to family members and other beneficiaries. Most important, a properly designed captive can help your clients sleep better at night because the captive can cost effectively insure their operating entities against a broad array of risks. Your clients will sleep more soundly when their businesses are protected against risks that are not currently covered.

Benefits of Forming a Captive Insurance Company

A captive insurance company can provide coverage when insurance is commercially unavailable or commercially overpriced. Your client's business might use a captive to reduce the risk of expenses related to: (1) gaps in existing coverage; (2) large deductibles on existing coverage; (3) "excess" protection costs; or (4) remote risk expenses, such as those created by the loss of a key employee, litigation expense, directors' and officers' liability, and unfair competition.

State and federal laws help captive owners sleep better. The captive's assets are protected from the claims of creditors and others because the captive is classified as a C corporation. Moreover, insurance laws protect the captive's reserves so that funds should be available to pay any claims that may arise.

Clients need not worry about taxes eroding reserves in captives, because contributions are tax-deductible under Internal Revenue Code section 831(b), and earnings can accumulate tax-efficiently.

The captive can also help your client eat better during retirement because the captive is funded with money that would otherwise be lost to taxes. Your clients' businesses can deduct up to CURRENT_PREMIUM_CAP million of insurance premiums each year and grow these funds in a tax-efficient investment vehicle for retirement income or family wealth transfers.

If the operating entity minimizes claims against captive reserves, a captive can allow for tax-efficient wealth transfer to your client's heirs. If your client chooses to create an irrevocable trust to own the captive, every premium dollar paid can constitute a tax-free transfer to beneficiaries outside the client's taxable estate. Of course, clients must use the captive for non-tax reasons; however, the tax benefits can supplement the risk management features of a captive.

Captives perform best when reserves grow tax-efficiently with good risk adjusted returns. It is reasonable to address tax and investment issues in an Investment Policy Statement ("IPS") because the Uniform Prudent Investor Act requires that portfolios managed for the benefit of others have prudent written standards. The captive IPS should address your client's desired investment returns, tax constraints, liquidity needs and risk tolerances. Because captives operate in an environment affected by income and transfer taxes, a seasoned captive advisor will draft the IPS to examine likely returns after income, capital gain, estate and gift taxes.

Captive Insurance Formation

Evaluating the benefits of a captive insurance company requires a careful assessment of several interrelated variables. If your client decides to proceed with formation of a captive, he or she should select a planning team with members who have demonstrated expertise in the following seven areas:

- 1. Plan design. Ideally, the captive illustration should include detailed cash flow projections for the CPAs, summaries of legal documents for the attorneys and flow charts for the client.

- 2. Plan administration. The captive formation process requires focused attention on the next action steps, ideally using web project management systems.

- 3. Tax law expertise. The formation and performance of a captive require knowledge of numerous tax issues.

- 4. Captive regulations. Different jurisdictions have varying rules for managing captives and operating the trusts that own the captives. Advisors should understand the client well enough to know which structures should perform best.

- 5. Life insurance. Experienced producers can illustrate how life insurance policies may provide better tax, investment and liquidity benefits than those available through non-insurance investments.

- 6. Investments. The IPS should clarify how captive funds may be invested to fund buy-sell agreements, retirement planning programs, as well as wealth and estate planning programs.

- 7. Property/casualty insurance. Advisors should know when the client should maintain commercial insurance and when to self-insure with a captive.

If your client is interested in learning more about whether a captive would benefit his or her business, the first step is to have qualified advisors develop a feasibility study. To help your client properly assess costs and benefits, the advisors analyzing feasibility should create a report with balanced recommendations regarding the above issues.

Captive Insurance Case Study

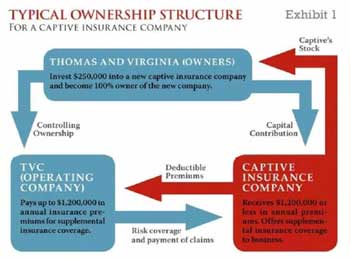

As shown in Exhibit 1, Thomas and Virginia own 100 percent of their captive's stock, as well as controlling TV Company ("TVC"), their existing operating business. Thomas and Virginia contribute $250,000 of initial capital to the captive during the formation process.

Each year, the captive manager performs an analysis regarding the types and amounts of insurance requested by TVC. When TVC pays premiums to the captive, TVC takes an income tax deduction. The captive, however, does not recognize taxable income upon receipt of the premiums, but only upon receipt of any net investment income exceeding the annual addition to the reserve for losses.

Exhibit 21 compares the advantage of paying claims from a captive versus paying claims from a sinking fund comprised of the after-tax earnings of the operating business. Note that after 15 years, more than $10 million of additional wealth accumulates in the captive in comparison to a sinking fund.

Captive setup costs normally total less than 10 percent of the client's tax savings. 2 Advisors should help their clients negotiate captive setup and administrative costs because many clients pay significantly higher costs than those assumed for Exhibit 2.

Conclusion

A captive insurance company can help your client sleep better without the risks that keep so many business owners lying awake at night. Proper design of the captive should help your client eat better during retirement while transferring more wealth to family members and/or favorite charities. Because the cost of a captive feasibility study represents only a very small portion of the tax savings, your client needs to act now.

Download a pdf copy of this report: Setting up a Captive Insurance Company here or complete the short form below for more information on setting up a captive for your business.