Stewart A. Feldman, general counsel to Capstone, attorneys Steven D. Cohen, Michael T. Kelly and Logan R. Gremillion of The Feldman Law Firm LLP, outside counsel to Capstone, talk to Captive Review about the risks of having non-tax professionals managing captives.

Stewart A. Feldman, general counsel to Capstone, attorneys Steven D. Cohen, Michael T. Kelly and Logan R. Gremillion of The Feldman Law Firm LLP, outside counsel to Capstone, talk to Captive Review about the risks of having non-tax professionals managing captives.

Captives are instrumental to many organizations’ risk solutions. As their popularity grows, so do the number of captive managers and the diversity of backgrounds of persons professing to be ‘captive managers’.

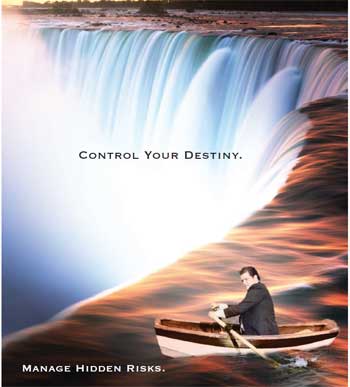

It is paramount for captive owners to ensure they have the best possible firms managing their captives. Given that captives’ tax and corporate structures are fundamental to alternative risk planning, can captive owners really take the risk with ‘captive cowboys’?

To find out more, Captive Review talked to attorneys Steven D. Cohen, Michael T. Kelly and Logan R. Gremillion of The Feldman Law Firm, outside counsel to Capstone Associated Services, and Stewart Feldman, Capstone’s general counsel.

Captive Review (CR): How critical is the tax and legal component of captive insurance management?

Steven Cohen (SC): First and foremost, captive insurance companies are creatures of the Internal Revenue Code. While certainly captives exist in non-US jurisdictions, their prominence in the US – something in excess of 75% of the world’s captives are associated with US insureds – is because these insurance arrangements are encouraged under the Internal Revenue Code.

Steven Cohen (SC): First and foremost, captive insurance companies are creatures of the Internal Revenue Code. While certainly captives exist in non-US jurisdictions, their prominence in the US – something in excess of 75% of the world’s captives are associated with US insureds – is because these insurance arrangements are encouraged under the Internal Revenue Code.

Because captives are sophisticated tax creatures (having been the subject of dozens of cases and rulings by the IRS, the Tax Court and various appellate courts over the past 70 years) the client is well advised to have a team of tax professionals responsible for the planning.

In the case of Capstone, we find that three or four lawyers with differing expertise are required to confer with each other when undertaking a captive project. The idea is to get it right.

Stewart Feldman (SF): We are regularly doing cross-border reorganizations of insurance companies, split-offs, spin-offs, and joint underwriting agreements, while addressing state nexus issues and current developments like the Dodd-Frank Act.

Stewart Feldman (SF): We are regularly doing cross-border reorganizations of insurance companies, split-offs, spin-offs, and joint underwriting agreements, while addressing state nexus issues and current developments like the Dodd-Frank Act.

In contrast, a small firm, or an accountant that claims familiarity with captives because he once filled out a tax return, can’t possibly provide the wide range of services needed to properly address captive planning.

Our firm is regularly offered the opportunity to fix others’ problems. Let me be clear: the IRS knows that many captives are managed by ‘cowboys’ in flagrant violation of established tax laws. And the IRS is acting on this.

SC: Captives must be operated according to three totally different sets of regulatory provisions: (1) the Internal Revenue Code; (2) the domicile where the insurance company has been established; and (3) the home state of the insureds.

Nexus or ‘legal connection’ exists in all three jurisdictions, which must be addressed simultaneously. The formation and ongoing management of a captive must be overseen by experienced professionals that understand the insurance, tax and legal aspects of the captive.

Because it is a regulated insurance company, our clients uniformly prefer to have a third party administer the captive on a turnkey basis, which has developed familiarity with the issues on dozens of assignments. For the same reason, most regulators demand ongoing professional management. It is the client’s responsibility to ensure that he has hired the right team to handle his work.

CR: How would you advise a client looking to hire a captive manager?

Logan Gremillion (LG): The decision to form and operate a captive is a serious financial decision. It is not planning for the light of heart.

Logan Gremillion (LG): The decision to form and operate a captive is a serious financial decision. It is not planning for the light of heart.

It is not for those who want to view a captive as a personal checking account. Operating a captive is labor intensive and requires specialized skills spread over a number of disciplines.

Even the largest US companies outsource the management of their captives. If a company is not prepared to do the planning correctly, captive planning will prove to be very unsatisfying.

SF: Here in the US, captive managers are usually small administrative services providers. The usual caveat when the client reviews his captive management contract is, “We are not offering any professional accounting, legal or tax services”.

This is like going to a wellness clinic and being told in the fine print that no medical services are offered! The services should be viewed as less than worthless. To most persons in the trade, a captive manager provides administrative services along the lines of a mailing address or a point of contact for the regulators.

Captive managers don’t draft insurance policies, which is generally the function of a senior insurance or corporate lawyer; they don’t price policies, which is done by a property & casualty underwriter, having designations like ARM or CPCU or an actuary who is an FSA; and they don’t purport to be responsible for state or federal tax issues, which is what a tax lawyer does.

A captive manager may be a CPA in that they fill out tax reporting forms, and no more. The question is: what professional is taking overall responsibility for the planning from a tax and regulatory perspective. I’ve never seen a captive manager do this, much to the surprise of clients.

CR: What problems have you seen develop?

SF: One example is the flavor of the month, by which administrators are putting clients into cell or segregated cell or separate business units (SBU) captives, or group captives. We’ve seen doctors and dentists put into this planning by captive managers with a contribution of less than $100,000 in annual premiums in states like Vermont, Utah and Arizona. We fear that this is a recipe for disaster.

CR: What is misunderstood about the role of a captive manager?

Michael Kelly (MK): Over the past few years there has been significant growth in captive insurance as alternative risk planning among middle market companies.

Michael Kelly (MK): Over the past few years there has been significant growth in captive insurance as alternative risk planning among middle market companies.

To serve those interests, there has been a correspondent growth in captive insurance managers. As Stewart, Steve and Logan have pointed out, you have to be the master of a number of different disciplines, including a high proficiency in the insurance regulatory environment of the domiciliary jurisdiction and applicable state and federal tax laws to be an effective captive insurance manager.

Unfortunately, in the rush to meet the growth in the captive market, many have jumped into captive management without the benefit of an interdisciplinary background. Some managers may have a good understanding of insurance policies and claims handling, but not a clear understanding of the insurance and tax regulatory framework in which they are required to perform.

Other managers may have a strong accounting background, but no real understanding of the nuts and bolts of insurance company operations. I have had the luxury of working with a team of tax, corporate, and insurance attorneys, as well as CPAs, ARMs and other insurance professionals to provide the interdisciplinary approach that I think is crucial to effective captive management services.

SF: We regularly get calls from clients that are nervous about the legitimacy of their captive arrangements, seeking a “second opinion”. The usual scenario is that the client has a captive manager that is “responsible” for the arrangement.

When we ask the client who is handling the federal income tax responsibilities of the alternative risk planning arrangement, we are usually told that the client’s CPA files the return. When we inquire further as to whom is taking charge of the state and federal income tax function, an uneasy air falls over the client.

Very quickly we see finger pointing, with the client understanding that he has a sham insurance arrangement operating. The CPA’s position is that he simply filed out the return, not looking further in the arrangement. Last month, a client called us after becoming increasingly uncomfortable with his US captive manager.

The captive management company was run by a defrocked lawyer, whose biography said he went to law school but didn’t reference that he was ineligible to practice law in every state. Digging further, the client discovered the captive manager recently emerged from bankruptcy and had judgments against him for failed tax shelters.

His recent bankruptcy filing was a no-asset liquidation. Only by carefully reviewing this captive manager’s materials did the client realize that no licensed professional ever took responsibility for the captive planning other than that he would pay up to $50,000 in legal expenses in the case of a tax audit. No one stood up and said, “We’re tax lawyers and we’re responsible”.

MK: There are other important factors to consider in selecting a captive manager, such as: How long have they been in the captive management business? How strong is their commitment to regulatory compliance? Do they take an interdisciplinary approach with appropriate input from legal, tax, and accounting professionals? What type of experience does the captive management staff have?

SF: In conclusion, with proper tax and legal oversight, alternative risk planning is a very effective tool for businesses.

Download a pdf copy of The Captive Manager Fallacy

--------------------------------------------

STEWART A. FELDMAN is tax attorney and CEO of Houston-based Capstone Associated Services, Ltd. Since 1997, Capstone has formed CAPTIVE_FORMATIONS captive insurance firms and maintains staffed offices in The Valley, Anguilla, British West Indies; Wilmington, Delaware; and Houston, Texas. STEVEN D. COHEN brings 35 years of tax and legal expertise to The Feldman Law Firm LLP. Cohen received his JD (1978) and BBA in Accounting (1974) from The University of Texas at Austin. He has been a CPA since 1977. LOGAN R. GREMILLION received his LLM from New York University’s Graduate Tax Program (2009), his JD from The University of Texas at Austin (2007), and his BBA in Finance from Texas A&M University (2004). MICHAEL T. KELLY has been practicing law since 1978, concentrating on banking, corporate, employment, insurance and real estate law. He received his JD from Baylor University (1978), and both a BS in Business Administration and a BA in Environmental Studies from Trinity University (1975).-----------------------------------------------------------------------------------------------------------------------------------------------------------