IRS Announces That Proposed Insurance Regulations Have Been Withdrawn

IRS Announces That Proposed Insurance Regulations Have Been Withdrawn

Captive Client Memorandum

February 21, 2008 - In a significant win for the captive insurance industry, the IRS yesterday announced that it has withdrawn the Service's recently issued (September 28, 2007) proposed regulations under Reg. §1.1502-13(e) (REG-107592-00) that would have amended guidance regarding the treatment of insurance transactions between members of a consolidated group. The proposed regulations would have affected corporations filing consolidated returns which included a consolidated captive insurance subsidiary.

While the proposed IRS regulations would have had no effect on the planning designed and implemented by Capstone, the poorly conceived regulations would have affected captive insurance planning for publicly-held companies. This resulted in a torrential outpouring of criticism of the IRS' proposed rules. The proposed regulations would have resulted in the elimination of tax benefits associated with certain related party insurance transactions which have been provided for by the courts in a number of captive insurance cases in arguing against the Service's "economic family" theory.

Over CAPTIVE_FORMATIONS Captive Insurance Companies Formed

February 2008 - We'd like to thank each and every one of our valued clients and referral partners for a productive and successful 2007. Last year, Capstone Associated formed its 71st captive insurance company for our growing base of middle market clients.

Our continued growth is a reflection of the broadening acceptance of alternative risk planning beyond the larger, publicly held companies where captive planning is commonplace. In addition, a number of our clients have formed additional captives-or expanded the scope of their current captives-in response to the growth of their operating businesses.

To the friends of Capstone Associated that postponed forming a captive insurance company for 2007, now is an ideal time to revisit captive planning. Early in the calendar year is the always the best time to begin evaluating alternative risk planning. Middle market companies will form more captives this year than ever before.

To the new clients of Capstone Associated that formed a captive last year, congratulations! You are now among the growing number of savvy business owners that are enjoying the significant benefits of captive planning--benefits that have long been realized by large, publicly-held companies.

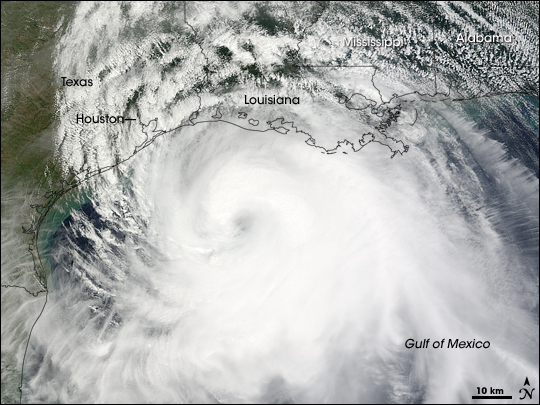

Post Hurricane Ike Update

Post Hurricane Ike Update

September 15, 2008 - We are happy to report that Hurricane Ike had no material affect on our operations. Our offices in the Houston Galleria, located in one of the largest, most secure office complexes in the nation, sustained insignificant damage. The Galleria complex is a fortress and is located far from Galveston Bay and the Gulf of Mexico. Our 22 story office building is equipped with multiple redundant systems and, as a result, we were never without power at any point during or after the storm. Key employees were in the office on both Saturday and Sunday and at no point was power, water or internet service interrupted. Rest assured all of our data and files are secure. Our systems remain fully functional, as you can see from our website, and from our uninterrupted phone and email replies today. Tax filings due today have been filed.

A small number of our Houston employees are still without electricity, phone and internet service at their homes (although water generally has remained available throughout the affected areas). Most cell phones and Blackberrys, however, are working. Local officials are saying it will be several days before residential electricity is broadly restored, with the exception of the hard-hit coastal communities like Galveston, which is more than 50 miles away from our offices.

In the meantime, if you need anything, call or email via normal communication channels. Thank you for your concerns.

What Will the 2008 Election Have in Store?

June 28, 2007 - The following is an interesting article widely distributed today on what the coming 2008 Presidential election may have in store. In this article, at a Democratic fundraiser Warren Buffett foreshadows what we see as a continuing theme seen in the business press calling for increasing income tax rates. The article states:

Buffett said he makes $46 million a year in income and is only taxed at a 17.7 percent rate on his federal income taxes. By contrast, those who work for him, and make considerably less, pay on average about 32.9 percent in taxes - with the highest rate being 39.7 percent.

To emphasize his point, Buffett offered $1 million to the audience member who could show that one of the nation's wealthiest individuals pays a higher tax rate than one of their subordinates.

"I'm willing to bet anyone in this room $1 million that those rates are less than the secretary has to pay," said Buffett.

To learn more, please contact us at WEB_TEL.

Welcome Harold Levine, Corporate Controller

We are pleased to announce that Harold Levine, CPA, MBA, has accepted the position of  controller for Capstone Associated Services Ltd. and our affiliated group of financial services companies.

controller for Capstone Associated Services Ltd. and our affiliated group of financial services companies.

Harold has been a CPA since 1974 and has extensive financial and controllership skills. In addition to his CPA, he has a Bachelor of Journalism in Advertising degree from The University of Texas and an MBA from Houston Baptist University. Most recently, Harold served as Controller/Business Manager of Latin America Broadcasting, Inc. (LAT-TV), a 28-station TV network based in Houston.

Harold is personable and exceptionally creative. He and his wife Martine are both very active in the Houston community. Martine owns and operates a successful catering business, and Harold as a hobby operates a 24-hour Internet radio station out of his home (www.radiobop.com).

Harold and Martine have lived in Houston for over 20 years and they have two adult children.