The American healthcare system is, by anyone’s standards, in a state of flux. “Repeal and replace” is still the mantra among most Republican leaders, as they seek an alternative to former President Obama’s Affordable Care Act (ACA). Even as talks continue among government representatives and new proposals are offered, there’s an undeniable fact that must be considered—several facets of the Obama’s healthcare plan are likely to remain intact; one of which is the performance-based compensation model, or capitation contracts for healthcare providers. Although this model has its advantages, it also carries major risks for mid-market healthcare providers.

Here, we’ll discuss how business owners can mitigate these potential risks with captive insurance planning as the healthcare industry continues to find its footing in an uncertain regulatory environment.

The Issue with Capitation Contracts

Prior to President Obama’s signature 2010 healthcare bill, almost all medical providers followed a fee-for-service model. It was simple; the more services rendered, the more the provider profited. However, this model created problems for the U.S. because it was spending far more on healthcare than other developed nations. According to recent OECD health statistics, the United States spent 16.4 percent of GDP on healthcare -- almost twice the OECD average of 8.9 percent. But despite all the funding allocated to healthcare, the country consistently had been performing worse, relative to other developed countries, in international evaluations of healthcare systems. This juxtaposition of high spending and low quality generated a sense of urgency for restructuring the system and has led to a wave of innovation in provider-reimbursement models (Source: The Committee for Economic Development).

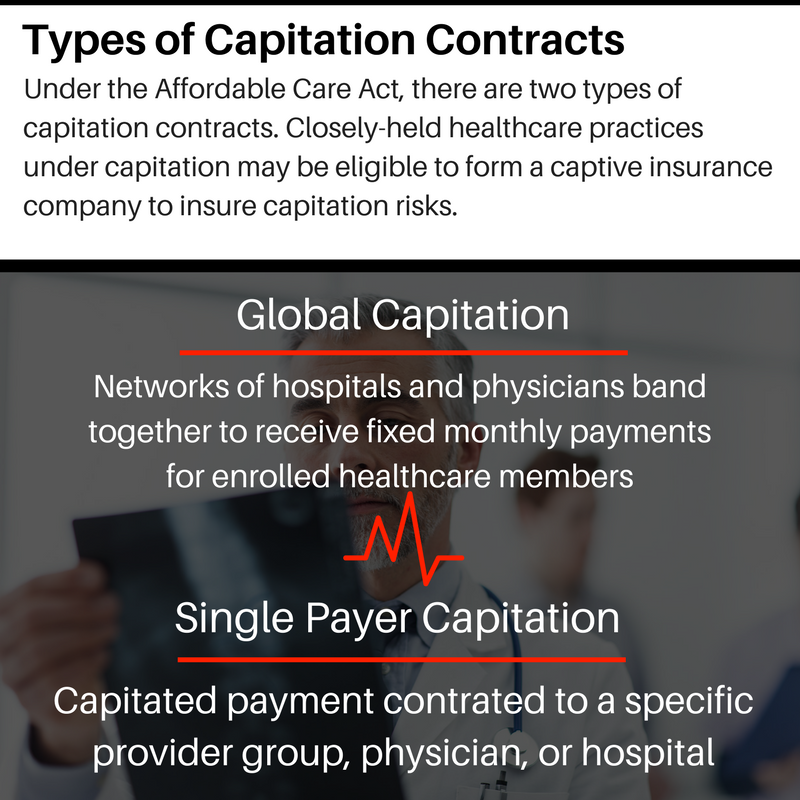

Under The Affordable Care Act, many healthcare providers moved from the fee-for-service model to value, or performance-based “capitation contracts,” whereby medical providers (usually HMO, ACO, or managed care organizations) are paid a set dollar amount per month by the government, per patient, regardless of how much care a patient requires. The more treatment a patient needs, the less profit the provider earns.

The theory is that if providers are incentivized for results — safety, outcomes, efficiency and patient experiences — instead of being paid for doing as much as they can, better care and lower costs will result (Source: The Big Change in Health Reform: Provider-Sponsored Risk).

Under capitation, healthcare providers effectively function as mini-insurers, who can earn a profit if the allotted funds aren’t fully utilized, or, can suffer a monetary loss if their patients are sicker and require more medical care.

Under capitation, healthcare providers effectively function as mini-insurers, who can earn a profit if the allotted funds aren’t fully utilized, or, can suffer a monetary loss if their patients are sicker and require more medical care.

This model was established by the Obama administration to foster improved health for individual patients by incentivizing healthcare providers, and improve the country’s healthcare industry track record. For Medicare providers, several versions of the accountable care organization (ACO), performance-based model were created to provide healthcare organizations options to take on financial risk and earn bonuses for keeping costs down and their patients healthier.

But at their core, capitation contracts are a calculated gamble. Healthcare providers can leverage these contracts as a means to boost profit while also making a quantifiable, and positive difference in their patients’ lives by investing in preventative medicine, healthy living support, and progressive medical treatment. Healthcare providers with low utilization of their allotted funds can expect better financial performance. However, the financial risk is a very real consequence. Healthcare providers are on the hook for costs in excess of their monthly stipend, which can be exorbitant if their patient population requires more care than they anticipated.

Additionally, hospital and health system board members must be prepared to analyze financial projections, weigh opportunities and risks, and keep their sights on the organization's health care mission and future investment needs to avoid negative financial outcomes. Compounding the issue of rising costs for capitated providers, is the required implementation of a digital version of a patient’s paper chart, referred to as the Electronic Healthcare Record. This requires a massive investment in an IT upgrade and support.

The initial intent for the technology was to create an overall cost savings, but these savings can take years to surpass the initial investment. Although all healthcare providers are required to implement electronic records, those under capitation may feel a greater financial strain. If a provider is under a capitation contract for a year or more, he or she will have to wait for their renewal date to renegotiate the terms. Typically, the costs for a major upgrade to their computer systems is not included in the capitation pricing and this creates financial barriers in adopting EHR technology. In contrast, those who’ve chosen to remain under the fee-for-service model have the opportunity to raise their prices, and thus mitigate the costs.

The Trump administration believes that with an overhaul of Obama’s healthcare legislation and the implementation of more market-based competition, patients will have better access to quality, affordable medical services. This may prove to be good news for some patients, but healthcare providers, especially those with a large Medicare population, will still struggle with the new reality of a performance-based reimbursement model.

The Trump administration believes that with an overhaul of Obama’s healthcare legislation and the implementation of more market-based competition, patients will have better access to quality, affordable medical services. This may prove to be good news for some patients, but healthcare providers, especially those with a large Medicare population, will still struggle with the new reality of a performance-based reimbursement model.

Forming a captive insurance company can help offset these potential capitation risks by pre-funding variable losses. By self-insuring via a captive under tax election IRC 831(b), medical providers can offset their financial burdens with premiums paid into a structure that pays a 0% Federal income tax on the captive’s underwriting profits and normal “C” corporation rates on investment income.

Implications of “Trumpcare” for Mid-Market Employers

For many small and mid-sized employers, The Affordable Care Act has been burdensome and unpopular, particularly because of its “responsibility provisions.” Under the mandate, business owners with 51 or more employees are required to offer health insurance. If they don’t, they’re subject to a $2000 penalty.

Proposals presented by the Republican majority and by President Donald Trump suggest that these employer mandates may not last, and theories about the viability of the ACA continue to evolve. But the current version of the ACA still stands and poses significant risks to healthcare providers. Case-in-point, in March of 2017, President Donald Trump proposed legislation, (dubbed The American Health Care Act, or “Trumpcare”) that would dramatically overhaul the current healthcare system, but it was struck down by House and Senate Republican representatives. In early May 2017, a newer version of the Act was voted in by the House, but Senate Republicans stand firm in their belief that some aspects of the Bill needed to be revised. New healthcare legislation in the U.S. will probably move forward at some point, but for now, the ACA still governs our healthcare system.

This is why the initiation of captive planning for healthcare providers subject to the mandatory provisions is a crucial step in keeping their businesses resilient. Captives can provide broader, more tailored coverage, regardless of pending legislative decisions. Captive coverages can pre-fund losses stemming from lawsuits, certain fees, regulatory changes, and more.

As lawmakers come to a consensus about healthcare in this country, business owners should anticipate their risks and take action accordingly. For an ACO or Physicians group, forming a captive insurance company has the unique potential to insure the possible negative impacts of capitation risks. While the future of healthcare is uncertain in this country, providers can ensure the stability of their businesses is not.