Forming an 831(b) captive insurance company allows businesses to proactively create a dedicated asset base to fund losses, improve cash flow, and provide investment income. It is why savvy mid-market business owners across the U.S. are adopting the 831(b) election. The video below explains.

The 831(b) Captive: How Does It Work?

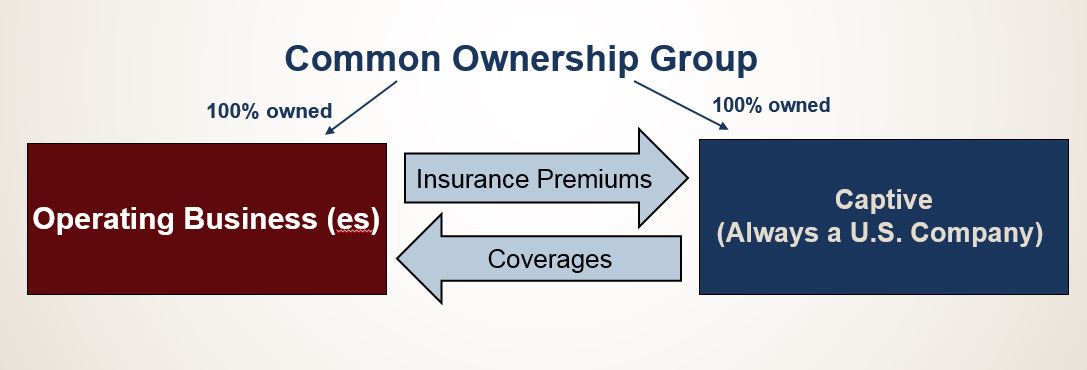

There are various captive types currently in operation, including single owner, group, and cell captives. All can all be formed under various sections of the Internal Revenue Code, including Section 831(b).

Captive insurance companies formed under the 831(b) election are structured to provide both risk coverage and financial benefits for mid-market for business owners.

In a typical captive arrangement, an operating company pays premiums to the captive. These funds accumulate over time and are available to the operating company to fund losses. Under Section 831(b) of the tax code, premiums paid to the captive are paid at a 0% Federal income tax rate on the captive’s underwriting profits. The financial benefits of captive planning should always come second to the insurance needs of the operating business.

The insurance benefits of captive planning are significant, filling “gaps” in coverage, which can otherwise lead to high out-of-pocket costs in the case of a loss event. Captives also eliminate the possibility of a claim denial, providing business owners with more control over their insurance program.

Historically, captives were reserved for large corporations. The passage of Section 831(b) of the Internal Revenue Code leveled the playing field, giving mid-market business owners the opportunity to form captives of their own.

831(b) captives are best for the mid-market because of its exceptional financial benefits--a captive with no more than CURRENT_PREMIUM_CAP in annual net written premiums is taxed only on its underwriting profits.

With 831(b) captives, coverage can be designed to account for many risks, including business interruption or the loss of key staff services that may occur as a result of a medical-related outbreak. Some business may be primed for risk exposures such as trade embargos, unilateral termination of contracts by a government, and cancellation of authority to conduct business in a certain jurisdiction. Captive coverages can be designed to address these specialty risks, as well as any other risks that haven’t been addressed by a business owner’s commercial policy; these coverages may be too expensive or unavailable in the traditional market.

Who Qualifies for 831(b) Captives?

Closely-held, private businesses in industries such as construction energy, transportation, manufacturing, healthcare and many others, are ideal candidates for 831(b) captive insurance. Coverages written under the captive are custom-built to address the specific risk financing needs of its affiliated business, avoiding a “cookie cutter” program.

The qualifications for forming an 831(b) captive insurance company include:

• Owning a closely-held, profitable business

• Insurable risk exposures inside the business

• Pre-tax profits of at least $1 million per year

In determining eligibility for an 831(b) captive, there are many technical considerations, including common notions of insurance, ownership structures, appropriate pricing of premiums and The Law of Large Numbers.

In general, qualifying for captive ownership should begin with an accurate assessment of risks. Remember, risks that are considered uncommon or industry-specific can be covered without standard exclusions. By way of an on-site business risk assessment, or feasibility study, business owners can form their captive while remaining compliant with the laws and rules set forth by the Internal Revenue Service and other regulatory bodies.

How are 831(b) Captives Regulated?

831(b) captive insurance companies are actual property & casualty companies, legally established to insure the risks of their related businesses. They are regulated by an insurance commissioner of a U.S. state or foreign jurisdiction, i.e. a captive domicile. The domicile ensures that captives adhere to regulatory changes, tax laws, and other provisions. Most experienced domiciles offer operating flexibility, regulatory compliance, and a progressive legislative environment. Onshore domiciles such as Delaware, and offshore domiciles such as Anguilla, can offer mid-market businesses the support and oversight they need to operate according to federal and state regulations.

Capstone’s experts work with each client to assess their business and level of risk. Partnering with a captive management firm with in-house legal expertise ensures your captive remains in good standing.

Forming Your 831(b) Captive with Capstone

Forming a fully-compliant 831(b) captive insurance company begins with partnering with a professional, experienced captive management company, like Capstone Associated Services, Ltd.

Capstone is a captive insurance planning company providing insurance management services, and accounting for captive insurance companies. It is the most comprehensive captive insurance planning available.

Capstone is a standout in the industry with over 25 years in operation. Unlike most other 831(b) captive managers, the team has the expertise design, implement, and manage your captive company and provide full support. Capstone's staff of insurance professionals includes CPCUs (Chartered Property & Casualty Underwriters), accountants and administrators.

Capstone has successfully formed over 200 since 1998, offering an award-winning, attorney-led captive insurance planning program that is unmatched in the industry. Our experts keep clients informed every step of the way.

For a free consultation, call us at 713.800.0550 or fill out our contact form. We’re looking forward to connecting with you.